State of the Market - U.S. Datacenter & Energy (2025)

Ar

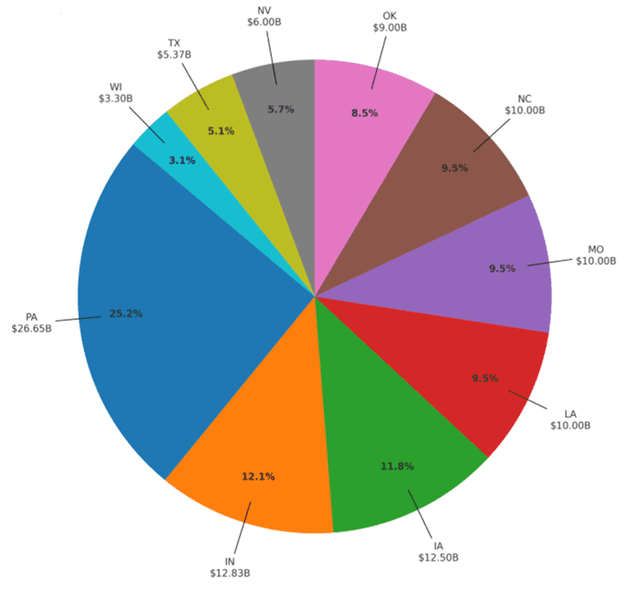

Scale and concentration are real: The data set I was able to find and build from includes 34 U.S. projects, with $108.9B disclosed CAPEX across 23 sites. Spend is concentrated: PA ($26.7B), IN ($12.8B), and IA ($12.5B) dominate, while Texas leads by project count (7 total / $5.37B disclosed).

Top 10 Commited 2025 US Datacenter Projects with Estimated CAPEX

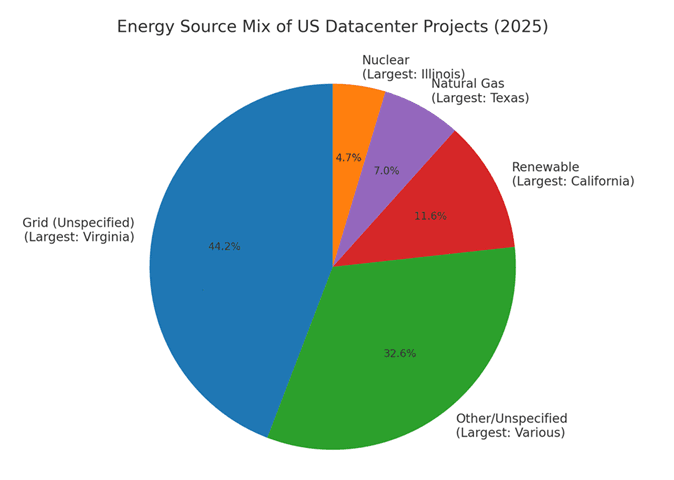

Texas is leading in volume, but with energy risk: Deck data and sheet confirm Texas is the most active project market, spanning from $31M niche builds to $3.5B mega-campuses. Energy sourcing leans heavily on on-site natural gas turbines (Crusoe, Rowan) as a reliability hedge, versus more grid + nuclear/renewable PPAs in PA, NC, and LA. This strategy provides uptime but increases exposure to fuel price volatility and emissions scrutiny.

Grid strain and policy shifts are escalating: ERCOT faces demand potentially doubling by 2030; Senate Bill 6 already empowers curtailment of “large flexible loads” like AI datacenters. Similar pressures are emerging in PJM (queue reform, cost allocation) and at FERC (Order 2023). Expect operators to increasingly shoulder upgrade costs or deploy on-site firm power, network and storage. Enter economies of scale and OPEX vs CAPEX cloud cost optimization down to the consumer.

National mix vs. Texas divergence: Nationally, the build pipeline tilts toward nuclear (AWS PA) and clean/renewable matching (Meta LA, CoreWeave PA). Texas, by contrast, remains gas-heavy. Federal incentives and state-level legislation could nudge diversification, but in the near term, ERCOT’s profile will be more fossil-dependent than the U.S. average.

GPU/HPC-oriented builds account for ~35% of disclosed dollars ($38.5B), anchoring the “AI-class” load. AWS, GCP and MSFT top that list in order of magnatude. Email [email protected] for the full list.

Legislation + shortages frame 2025–30 as a crunch: DOE, EIA, and multiple utilities are already flagging record demand growth, with AI loads projected to more than double data center share of US power consumption by 2028.

Coming Soon:

• Global Energy Strategy, tariffs, nuclear cost & dependencies

• EMEA/APAC EED Emissions Regulations

• 2025-2030 Closing the US Energy Gap

Best,

Arielle